Fundamental Analysis

Compared to technical analysis, which is focused on the price action and trends to find out how the price direction will move, fundamental analysis considers all available data on news and events from the financial calendar. Traders who are focused on fundamental analysis are looking for differences between the most recent prices and their own valuation to spot trading opportunities.

Deeper in Fundamental Analysis

Fundamental analysis is based on different data, issued for free from companies and governments for the public. They include corporate earnings reports, geopolitical events, central bank policy, environmental factors. There are many factors which influence these reports and eventually the markets.

Inflation

Inflation is the level at which the prices for goods and services raise. Central banks try to limit the raising rates, in order to keep the economy running safely. They try to do so by hiking the interest rates. When a rate hike is announced, the respective currency is appreciated.

GDP

Gross Domestic Product is a measure of all goods and services produced yearly. Traders and investors look at GDP growth to know if the economy is getting stronger or weaker. When the economy is getting stronger, companies generate higher profits and people generate more money, which eventually lead to a rise in the stock market and a stronger currency.

Unemployment

Information from labour markets is presented by non-farm payrolls, which has usually high influence in indices and forex markets. It is released on the first Friday of every month. It shows the total number of paid US workers of any business. Let’s say for example that the non-farm payroll is increasing, this is usually interpreted as the economy is getting stronger and people tend to raise their investing levels.

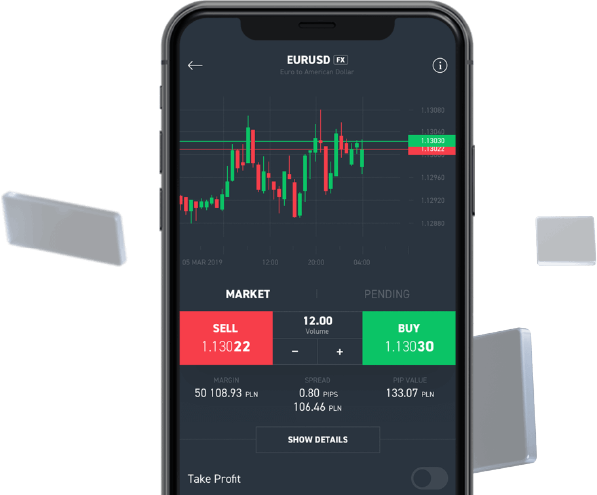

START TRADING TODAY

Fund your account with a minimum of €250, and expose small

portions of your capital into financial markets.